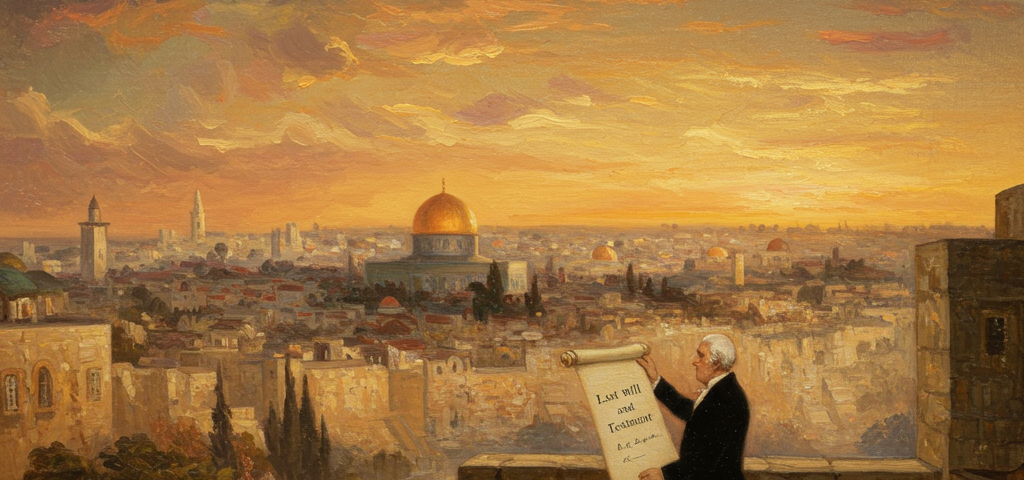

A British businessman purchased a property in Jerusalem when in his will, which was prepared by his lawyer in the United Kingdom and was also probated in the United Kingdom after his demise, it was set that the property would be inherited by his son. However, the Israeli authorities refused to accept the probate order because it is not an order of an Israeli Court and the Israeli Court requires a long and expensive procedure to issue an Israeli probate order for a foreign will. Is it possible to avoid the legal and financial complications?

In order to probate in Israel a will made outside thereof, a probate order procedure is required in Israel, even if such a procedure has already been carried out in another country. As part of the procedure, which has high costs and may also take a long time, it is also necessary to bring an expert opinion regarding the law in the country in which the will was made, because each country has different and unique inheritance rules according to which the person's property is divided upon his demise and these are not necessarily identical to the law applicable in Israel. Thus, for example, in Israel, a person is entitled to bequeath his property according to his choice and even to disinherit spouse or children, if so wishes. In contrast, in some countries, inheritance laws include precise provisions regarding the percentage of inheritance that the testator is obligated to bequeath to immediate family members, such as a requirement that part of the property is obligated to be bequeathed to the spouse or to descendants (children and grandchildren). In addition, there are different rules for drafting a will in each and every country, and the expert opinion is required to show that the process of writing the will was duly made. Thus, for example, a case handled by our firm some time ago, involved heirs of a property in Israel bequeathed in a Swiss will, from which the other heirs wished to withdraw in the favor of one of them, as can be done in Israel. The process required a great deal of time and costs in the Israeli Court, including the need to file an expert opinion as to the legality of the process under Swiss law - all of which could have been saved had there been an Israeli will. In contrast, a case recently handled by our firm involved children of a deceased woman, all of whom live in the United States of America, who sought to withdraw from the estate in favor of one of them, who lives in Israel. In that case less than a month took for a probate order to be issued and sent to the Land Registrar in Israel for execution.

Therefore, it is recommended to any person who is not a resident of Israel, but has assets in Israel, to ensure that a will will be drawn up by an Israeli lawyer, and usually preferably by an Israeli notary public (as a notarized will is stronger and more difficult to attack later, especially when it comes to an elderly person) and which will apply to the assets in Israel. In this regard, it is important to note that under certain conditions, an Israeli notary can also reach the client outside of Israel and sign a notarized will without the testator being required to come to Israel for such purpose.