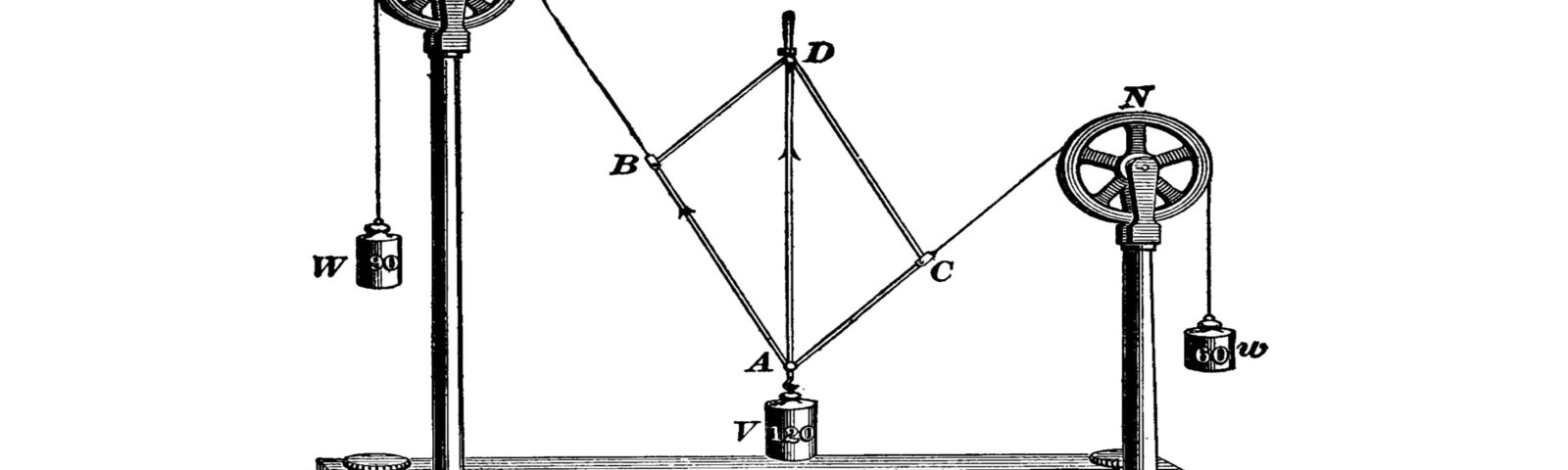

Anyone who graduated in physics (or studied mechanics) knows (or should know) the concept of "Parallelogram of forces" - the aggregated force of the two acting forces is the diagonal vector in the parallelogram created, or in the business field, the more complicated a transaction is, the less those involved in the transaction pay attention to the details or to dealing with the important issues that may hinder the transaction... and D&O insurance, as we all know, is a complicated issue that the lawyers and certainly the businessmen, do not usually understand, and it "may hinder" the transaction...

An insurance contract, as a rule, is forward-looking and aims to cover risks that are not certain to occur, but such risk may be reduced by paying the insurer a premium determined on the basis of an assessment of chance, risk, the insured's history, and the relevant industry. Accordingly, any insurance, as well as D&O (directors and officers) insurance, is based on a risk assessment performed by the insurer in accordance with the purpose for which it was purchased; the period for which it was purchased; the premium paid for the evaluated defined and known risk and other factors. To that end, there is tremendous importance to the manner by which the insurer is approached, including understanding the risk, assessing it and making the insurance policy text accurate. This is certainly the case when approaching the insurer upon occurrence of an insured event, as it is cardinal to approach it correctly, duly manage the process and coping with the insurer contentions as to the cover.

For example: an American businessman founded a SPAC, raised about USD 80 million but also invested personally and was the largest shareholder in the SPAC. As is customary in SPACS, the SPAC was required to merge with a target within two years, and so it did, however, the merger failed and resulted in a lawsuit in the US contending that the directors were in a hurry to approve the merger without performing the necessary checks, all with the aim to save their personal investments. The SPAC finally merged with an Israeli cyber-attack company, which procured a D&O insurance, but this merger also resulted in legal proceedings against the officers. The insurer refused coverage contending, inter alia, that the claim relates to actions (in both merger transactions) in the business man's capacity as a director of the SPAC and not in the merged company (although the insurance included a back-dated coverage), and that the SPAC D&O insurance paid the full coverage as part of the run-off coverage (coverage for the period after the end of the insurance, which applies only to events relating to the insurance period). In February, 2023, the Tel Aviv District Court rejected the majority of the ILS 13 million lawsuit after reviewing the language of the policy and finding that the SPAC did not appear in the definition of the insured companies and the coverage applies only to activity in the defined field (technology) of the new company founded after the merger.

This example illustrates the fact that even (and not only) in complex transactions, such as a SPAC or other M&A (merger and acquisition) transaction, it is important not only to accurately insure the risks, but also to use an expert insurance broker with experience in the field, including understanding the policy and its complexities, the pertinent regulation, practices and tactics of negotiation with insurers upon contracting and upon occurrence of an insured event, and one that may smartly apply commercial leverages. Additionally, it is vital to also employ a lawyer with experience in the field and with working with such insurance broker, so that the lawyer can manage the process with an overview of the insurance and other business considerations. At the end, there is only one law stronger than the laws of physics and mechanics, and it is Murphy's law (and by analogy with the 'parallelogram of forces': the less good the insurance, the higher the chance that it will actually be required).